What is secondary market research?

Last updated

3 April 2024

Reviewed by

Market research is crucial for all businesses. You must understand your market at every stage, starting with your business plan. Market research is an ongoing process as business and consumer preferences, needs, and wants are constantly changing. In this article, we'll examine secondary market research, why it's important, and how to get the most out of it.

There are two main types of market research: primary and secondary.

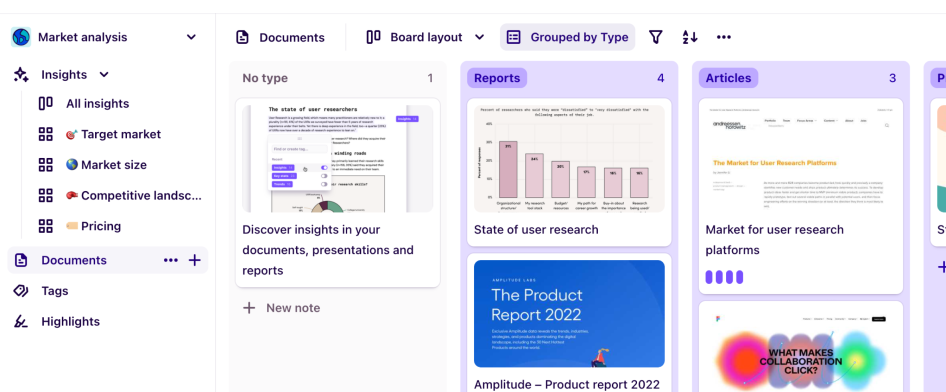

Market analysis template

Save time, highlight crucial insights, and drive strategic decision-making

Use template

Primary research is research that is collected first-hand. Methods of obtaining primary market research include the following:

Interviews: Phone, online, or in-person interviews

Focus groups: Small groups that informally discuss an issue

Polls and surveys: Commonly sent to customers via email or social media sites

Observation: For example, observing how shoppers, drivers, children, or any other group of people behave in a certain situation

One of the main benefits of primary market research is that it's specific to the business or organization that collects it. For example, if you poll your customers, you get feedback from people who have bought your products. The downside of primary research is that it can be expensive and time-consuming to collect.

Secondary market research

Secondary research is research you obtain from another source rather than collecting it yourself. This is research that may be found online or in print. It may have been collected by businesses, governments, nonprofit organizations, or other sources.

What are the main sources of secondary market research?

Common sources of secondary market research include the following:

Published data

Demographic data published online, such as on sites such as Statista and McKinsey, government sites such as the Census Bureau and the Bureau of Labor & Statistics, universities, and other sources. Publications such as magazines and academic and trade journals also publish valuable data.

Unsolicited customer feedback

This includes emails, social media posts, and reviews published on third-party sites such as Yelp, Facebook, Google, and elsewhere.

Previously collected data

Studies, focus groups, and other data collected in the past become secondary when you revisit it later.

Competitive research

Finding publicly available data on your competitors. For example, using a tool like Ahrefs or Semrush to get website SEO information.

What is the purpose of secondary market research?

Secondary market research supplements or complements primary research. It's also a viable alternative when you don't have the time or resources to do primary research.

Why you should perform secondary market research

There are obvious advantages to doing primary market research. It's the most relevant and timely research you can do. However, there are also some compelling reasons to perform secondary market research. This type of research can be particularly useful for startups and newer organizations.

A startup or new business doesn't have a large pool of customers to draw from. While they can do other types of primary research, such as focus groups, they’re limited when it comes to methods requiring feedback from customers or members. In this case, looking at existing data from competitors or more general demographic data can fill the gap.

Primary and secondary market research are complementary

Primary and secondary research aren’t mutually exclusive as both have value. Secondary research can back up your primary research. It can allow you to see if your competitors' research or data is similar.

For example, suppose a company that creates fitness-related products and services wants to launch an app that helps people plan healthier meals. It would be helpful to conduct primary research, such as a focus group or user testing of a beta version. However, it could also help to study any existing research about competitor apps, such as the demographics of customers, most popular features, and how many customers upgrade from the free to the paid version.

Primary research can give you crucial feedback on how users react to your app. However, secondary research backs this up by giving you general data on your market and KPIs that you can benchmark from.

When is the best time to do secondary market research?

Ideally, you should undertake secondary market research before primary research. It provides an overview of a target audience, demand for products, the competition, and the typical price points for similar products and services.

Secondary market research tools and strategies

Let's look at some guidelines for performing secondary market research.

Internal resources: analyzing data you already possess

Every company or organization has data that’s gathered as a byproduct of daily transactions or interactions. This includes feedback sent to you by customers or published on social media or review sites.

An example of a simple but important business metric is the return rates for products and services. Other data includes customer churn, comparing the popularity of different versions of a product, and tracking sales during different seasons. These are all metrics that most companies routinely collect.

Companies can also look at data regarding their employees and the hiring process. Metrics such as employee turnover and the effectiveness of training programs can help to inform future policies.

Qualitative vs quantitative research

Secondary research, like primary research, may include both quantitative and qualitative data. Metrics, such as sales figures and return rates, are quantitative. Qualitative feedback is equally worth studying. Examples of qualitative data include customer service calls and emails.

Listening to or reading the words used by customers can provide insights into sentiments about your product and business. Factors such as tone of voice, emotions, and body language (e.g., in a video review) provide qualitative information.

External resources

You can also access resources that are outside your organization. In addition to publicly released data, either online or in print, you can work with market research companies that specialize in market research data.

In addition to offering free resources, companies such as Statista offer more comprehensive data with paid accounts. Another useful resource is Green Book's list of the Top Full-Service Marketing Research Companies.

Social listening

Social media provides a rich and cost-free way to conduct market research. Studying social media posts, stories, groups, and pages is especially useful for gathering qualitative insights. You can research social media content for competitors and companies that are similar or adjacent to your own.

How to conduct secondary research

The following are the steps for conducting secondary research.

1. Identify and define the research topic

To collect the data you need, you must first identify the topic and reason you want this data. Ask yourself several questions:

What is your primary goal?

For example, a store or restaurant may be considering opening a second location in another city. They would do market research to determine whether there's sufficient demand for such a business in the proposed location.

Who are your customers?

A company releasing a game might decide that their typical consumer is between the ages of 16 and 22. Identifying a buyer persona is a good starting point. A buyer persona identifies ‘typical’ customer traits such as gender, age, location, profession, education, and other factors.

Who are your main competitors?

Studying the competition is always a critical factor in market research.

2. Find research and existing data sources

For secondary research, you need to locate existing sources of data. You can search both internally and externally for research that matches your needs. Be open to researching any of the relevant sources, such as those listed above.

3. Begin searching and collecting the existing data

There is no shortage of data in the world today. The challenge is sifting through what you need, discarding what is not relevant, and placing it in the right categories. By selecting your parameters beforehand, you won't get distracted by data that isn't relevant.

4. Analyze the data

Once you have the data you need, it's time to organize it, put it into the appropriate categories, and analyze it.

Look for patterns and long-term trends

For example, if you're looking at numbers such as sales figures for a certain brand or product, look for trends over time. An isolated piece of data could just mean a temporary spike (or drop) in popularity.

Verify the validity of the data

Checking your data is especially important with secondary market research as you're relying on data collected by others. Consider if the sources are reliable. Some websites and publications, for example, may be biased or untrustworthy. While social listening is valuable, it can be misleading if you aren't careful verifying the sources. For example, reviews can be fake to artificially pump a product. Whenever possible, check data against other sources.

Be cautious of cognitive distortions when analyzing data

Researchers who are hoping for or expecting a certain result may fall victim to confirmation bias. One sign of this is prioritizing data confirming your biases and ignoring data contradicting them.

Examples of secondary market research

Here are a few examples of both internal and external secondary market research:

External secondary market research: studying your target audience

For this type of research, you need to identify your target audience or buyer persona.

Publications, social media, journals, and interviews can provide useful qualitative data on many topics. For example, if you’re researching the shopping habits of millennials, you could look at data published by Retail Customer Experience, which reveals that 80% of millennial shoppers do most of their shopping online, up from 60% three years earlier.

You may need more specific data, of course. Your target audience may be older or younger millennials (or members of other generations).

Measuring the popularity of a product or trend

Another type of external secondary research involves studying consumer demand for a product based on current trends.

Suppose you have a chain of restaurants and you’re creating a new menu item, say a plant-based burger. As developing and releasing new products or services can be costly, it would be wise to do market research first.

Primary research might include taste tests and polls of favorite flavors for a new food offering. However, you could learn a great deal from secondary research. This might consist of trends for people seeking meatless alternatives, for example. You could also research the competition by looking at the popularity and price points of similar items sold by other restaurants or competitors.

Internal examples of secondary market research

Marketing Sherpa provides several insightful examples of both primary and secondary market research. One example of internal secondary research they mention is a virtual event company that created printable baby shower thank-you cards. The company knew from talking to customers that people preferred having a printable swipe as opposed to a virtual image on a screen.

Another example from Marketing Sherpa explains how Intel organized its existing databases to conduct more efficient market research. Databases were organized based on criteria such as customer segment and geography. The data was compiled from customer interviews. Intel was able to create multiple versions of the database that different departments within the company could use.

Advantages of secondary research

Easy to find

It’s generally much faster to access secondary research than to do primary research. Whether you’re using internal or external sources, there is an abundance of data available on many topics.

Lower cost

Much is available for free online. Even paying to access secondary data is usually less expensive than conducting primary research.

Helps you conduct more insightful primary research

If you plan to do your own research, doing preliminary secondary research can help you save time and avoid unnecessary work. For example, if you discover insufficient demand for a product from secondary research, you won't need to do primary research on it.

Disadvantages of secondary research

Data may not be specific to your needs

By definition, secondary research has been done by others and may not apply directly to your organization.

May be outdated

Trends change quickly in many industries. If you access data from a few years ago, it may no longer be accurate.

May not be accurate

When others collect data, it can be difficult to gauge its validity. You must be careful about verifying the sources and methods used to collect and analyze the data.

Summary: what is the purpose of secondary research?

Secondary research is faster and less expensive to obtain than primary research. You can conduct a great deal of this type of research online.

You can do secondary research from both internal and external sources.

When analyzing data from external sources (e.g., websites, publications, social media), it's important to verify it.

Secondary market research is often best done when you’re starting out on your research journey. It can guide you on what further research is worth pursuing.

Primary and secondary research complement one another to give you a more comprehensive view of your market and target audience.

Should you be using a customer insights hub?

Do you want to discover previous research faster?

Do you share your research findings with others?

Do you analyze research data?

Editor’s picks

Last updated: 3 April 2024

Last updated: 17 October 2024

Last updated: 13 May 2024

Last updated: 13 May 2024

Last updated: 16 February 2025

Last updated: 10 January 2025

Last updated: 13 May 2024

Last updated: 3 April 2024

Last updated: 13 May 2024

Last updated: 3 April 2024

Last updated: 3 April 2024

Last updated: 3 April 2024

Last updated: 14 November 2024

Last updated: 2 October 2024

Last updated: 12 September 2024

Last updated: 23 July 2024

Last updated: 22 February 2024

Last updated: 13 May 2024

Latest articles

Last updated: 16 February 2025

Last updated: 10 January 2025

Last updated: 14 November 2024

Last updated: 17 October 2024

Last updated: 2 October 2024

Last updated: 12 September 2024

Last updated: 23 July 2024

Last updated: 13 May 2024

Last updated: 13 May 2024

Last updated: 13 May 2024

Last updated: 13 May 2024

Last updated: 13 May 2024

Last updated: 3 April 2024

Last updated: 3 April 2024

Last updated: 3 April 2024

Last updated: 3 April 2024

Last updated: 3 April 2024

Last updated: 22 February 2024