Surveys 101: When, where, and how to use them

Last updated

4 March 2023

Reviewed by

Asking questions and getting answers: How complicated can creating a winning survey really be?

Surveys are the bread and butter of high-quality customer research and product development. They’re an excellent research tool for behind-the-scenes sleuthing into your target audience's experiences, preferences, and pain points.

Are you looking to ask a few key stakeholders for their detailed insights about a niche topic? Perhaps you want to collect more opinions and experiences from your target audience. Using a well-crafted survey ensures you collect the data you need to improve your product or service.

Are you really getting the most out of your surveys? Read on to take your next survey to the next level with our must-read tips and tricks!

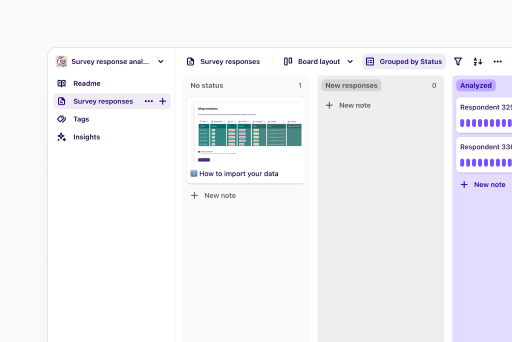

Free template to analyze your survey results

Analyze your survey results in a way that's easy to digest for your clients, colleagues or users.

Use template

What is a survey?

A survey is a research tool for gathering vital information from a set group of people or population. As a list of questions, a well-crafted survey aims to get a deeper and more comprehensive understanding of your target audience.

The style of questions and the type of data collected will depend on the desired outcomes of the parent project. You can create surveys to collect quantitative data (numeric values or statistics), qualitative data (anecdotal experiences), or a mix of both.

The purpose of surveys

For many project managers, rushing past customer research and survey deployment can be tempting—especially if you have internal pushback or tight deadlines.

As convenient as it would be to skip this step, it’s important to remember the unsung hero of every successful project: The time you take to create surveys. This is how you collect valuable data, so try your best not to rush past it!

Every survey you create will have a specific purpose and goal. Broadly speaking, your survey should help your team achieve at least one or more of the following purposes to be effective:

Understanding of your customers and target audience

To best serve your customers and clients, you need a comprehensive understanding of their preferences, problems, and how they spend their time and attention.

Surveys are a great way to discover who buys your products or services and why they choose your brand over your competitors. Asking specific questions about lifestyle habits, demographics, and experiences can uncover elements you hadn’t considered.

It’s easy to overlook these often simple-seeming questions, but the better you understand your customers, the more likely they will connect to and interact with your brand.

Gauging current public interest and opinion of your brand

How do people talk or feel about your company?

The general public view of your products and services is critical, and it’s something that your team should collect data on to analyze. This is especially vital after product launches, design refreshes, and changes to your service or product offerings.

A well-designed survey can give you access to the public’s unfiltered opinion of your brand, which is necessary for long-term company success and marketing.

Collecting direct feedback on your product or service

Which sounds like a better option: Improving your current product based on direct feedback from your top users or arbitrarily updating your offerings based on what you think your target audience might want?

Hopefully, the answer is obvious.

You should value any direct customer feedback like gold. Conducting a survey correctly can give you plenty of “gold nuggets” of feedback. You can integrate these into every product redesign stage, saving your company and team plenty of time, resources, and stress.

Types of surveys

Depending on the type of project you’re conducting, there are four primary types of surveys that you can use:

In-person surveys

Most commonly conducted as an interview, this type of survey offers a more intimate and personal approach to collecting data.

In most cases, in-person surveys are the most costly and time-consuming type. As such, companies often reserve them for collecting data from key stakeholders rather than a broader target audience.

Telephone surveys

You can use phone surveys for warm and cold call outreach. They’re a great tool for scheduling time with high-value interviewees, or you can use them for cold-calling research.

A short five or ten-minute conversation can give your team plenty of insightful information to use during your next project.

Paper-and-pencil surveys

Physical surveys (either in-person at your company’s office or store or mailed to participants) are an excellent way to get quick information from your customers or key stakeholders.

Many businesses are moving away from paper-and-pencil surveys and opting for online options.

Online surveys

As the most common and cost-effective option for conducting a survey, many businesses choose to go virtual with their data collection.

Sending out survey emails or adding a feedback option to your website is a simple and effective way to get a larger volume of responses. That enhances the accuracy of your survey results.

The benefits of online surveys

Virtual surveys offer the most bang for your buck when it comes to outreach capacity, response times, and adaptability. If your team is considering a user survey for an upcoming project, a digital option offers the following benefits:

Get faster results in a higher volume

Online survey software makes data collection fast, efficient, and easy to manage. Your respondents can complete an immensely valuable survey in a few clicks from an outreach email.

Virtual surveys produce a 30% response rate on average, making them significantly more effective than manual options.

Additionally, your team doesn’t have to do anything to record the data from this higher volume of responses. You can sit back and watch the data flow into your inbox, ready for analysis when you’re ready.

Save budget and resources

Digital survey options are a cheaper option compared to traditional survey options. Instead of paying for additional management expenses like interview resources and postage, you can manage your online survey and send it to a larger group of people for a fraction of the cost. Plus, you’ll get potentially better results.

Collect more accurate insights

Traditional paper surveys are more likely to result in user errors, impacting the accuracy and reliability of your results.

Because online surveys have become so prevalent, most people know how to complete them. Online survey options allow you to avoid clunky clerical mistakes and collect accurate information more promptly and effectively.

How to create an effective survey

Are you new to survey design, or have you been running high-level surveys for years?

When it comes to building a survey for your company, a few early-stage planning steps can make this process as painless and successful as possible:

Define your research question

The true foundation of every survey is the guiding research question—the reason you’re creating a survey in the first place.

Ask your research team some questions:

What are you trying to figure out?

What do you want to learn about your target audience?

How will your team use this information?

Ask these questions and get specific about the answers. This will be essential down the line as you design your survey to give you the information you need to succeed.

Home in on your target audience

Next, you need to clearly identify the people you’ll target as survey participants. Are you seeking insights from existing customers, key stakeholders, or internal team members?

The answer to this question will determine how you create your survey.

Brainstorm potential survey questions

Writing out a list of potential survey questions is a great way to start the survey creation process. Be sure to write multiple versions of each question to see which wording best fits your needs, and you can test these questions in the next stage of your planning process.

Pre-test your first drafts

After compiling a list of questions you want answers to, testing your survey before releasing it to your target audience is essential.

Pre-testing your survey is one of the best ways to identify points of confusion, evaluate the strength of questions, and get valuable feedback from a smaller set of respondents.

Select your sample size

Depending on the type of research you’re looking to conduct, the number of participants (sample size) varies greatly.

Generally speaking, surveys looking to collect quantitative or statistical data often need higher response rates to provide accurate insights. Qualitative and anecdotal survey questions need fewer leads to provide benefits as long as they’re high-quality.

Send your survey

Once you’ve tested your survey, it’s ready for your target audience. Based on research during the earlier stages of your planning, you’ll know how to best reach your participants (via email, social media, etc.)

Review the data

Now the real fun begins — you get to reap the benefits of your hard work and analyze your survey data! Using analysis software or manual data processing, your team can analyze and interpret your data to better understand and serve your customers with upcoming projects.

Five ways to get the most out of your next survey

Now that you know the basics of survey creation, let’s take your skills to the next level. Here are our top five tips for getting the most out of any survey:

Add a brand-specific design to your survey

The design and aesthetics of your survey play a role in getting participants to provide helpful insights. Using company logos, colors, and other themes to brand your survey will help your survey stand out.

Quality check your data

Unfortunately, not all data will be high-quality. It’s vital to filter through your responses to assess the validity and relevance to gain the most accurate view of your users. You can do this with survey software or by hand.

Avoid redundant questions

Whenever possible, avoid asking repetitive questions. This prevents survey fatigue. Questions at the end of a survey get less attention than those at the front, so front-load your survey with questions you want answers to. Avoid repetition to minimize confusion or irritation.

Use the right survey channels

No matter how well you design your survey, if you don’t reach out to your target audience through the correct channel, you will not get the results you are looking for. Researching how best to reach your audience is essential for getting the best survey results and responses.

Ask for permission to follow up

You may want to ask a participant additional questions about their responses. We recommend asking permission to follow up at the end of your survey. If they say yes, great! If not, you won’t inconvenience or annoy a participant who doesn’t want to continue.

Using survey results to improve your business

Once you collect your survey data, it’s your team’s responsibility to use this information to guide upcoming projects.

This is the end-game of every survey: Collecting and interpreting participant data to better understand and target your customer’s needs, wants, and concerns with your product.

From this information, your team should feel more confident as they begin conducting product updates or design refreshes or expanding into a new industry or niche.

So, be sure to use your survey data to its full capacity and integrate the results you collect into every stage of your next project.

Using authentic and accurate feedback from your target audience is the best way to meet their needs and edge out your competitors. Get out there and survey!

NPS calculator

Your Net Promoter Score is calculated by subtracting the percentage of Detractors from the percentage of Promoters.

0

NPS score

Detractors

0Passives

7Promoters

90

NPS score

Should you be using a customer insights hub?

Do you want to discover previous survey findings faster?

Do you share your survey findings with others?

Do you analyze survey data?

Editor’s picks

Last updated: 28 June 2024

Last updated: 16 April 2023

Last updated: 20 March 2024

Last updated: 22 February 2024

Last updated: 13 January 2024

Last updated: 21 December 2023

Last updated: 13 January 2024

Last updated: 26 July 2023

Last updated: 14 February 2024

Last updated: 26 February 2025

Last updated: 18 December 2024

Last updated: 16 February 2025

Last updated: 30 January 2024

Latest articles

Last updated: 26 February 2025

Last updated: 16 February 2025

Last updated: 18 December 2024

Last updated: 28 June 2024

Last updated: 20 March 2024

Last updated: 22 February 2024

Last updated: 14 February 2024

Last updated: 30 January 2024

Last updated: 13 January 2024

Last updated: 13 January 2024

Last updated: 21 December 2023

Last updated: 26 July 2023

Last updated: 16 April 2023