The 12 most common survey question types

Last updated

22 April 2023

Reviewed by

Relevant feedback is vital to planning and improving successful projects. How can you create a survey that gets you quick and accurate results? Check out this comprehensive list of survey question types so you can make the most of your next survey.

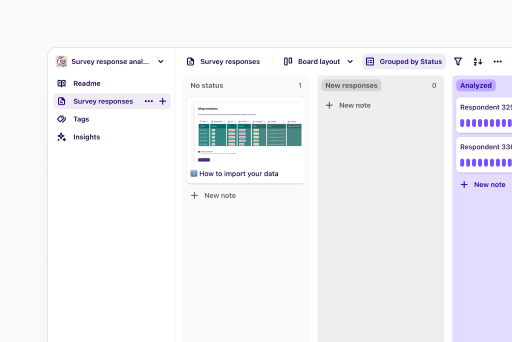

Free template to analyze your survey results

Analyze your survey results in a way that's easy to digest for your clients, colleagues or users.

Use template

Types of survey questions

We can organize survey question types into two broad categories: open-ended and closed-ended.

Open-ended questions allow the respondent to answer in their own words and express their opinions in full. Close-ended questions let the respondent choose from a list of possible answers you provide. Your specific survey design may use some of each or entirely one or the other, depending on the insights you need and the characteristics of your respondents.

In general, open-ended questions generate rich data that helps you understand the breadth and complexity of the topic you’re surveying. But these answers are long and difficult to summarize across your entire population.

Close-ended questions are ideal when you have a good idea of the specific questions you need answering and can easily create the categories or scales to answer them. Close-ended questions are easier to summarize across all respondents and are especially useful when surveying a large number of people.

Multiple-choice questions

Multiple-choice questions are useful for acquiring clear, easy-to-code answers about your topic. They’re easier for the survey respondent to answer because they can choose between your predefined answers without overthinking. A well-thought-out and intuitive set of answers can provide you with useful feedback in a way that’s clear and simple to the respondent.

One challenge with using multiple-choice questions is that because the answers are prepared and often mutually exclusive, certain respondents may feel isolated from the survey if they do not feel that any of the choices accurately reflect their personal experience or opinion. You can mitigate this challenge by offering an option of "Other, please explain."

Example: What was your number one reason for choosing this product? A) Price B) Product appearance C) Advertisement D) Recommendation from a trusted source E) Other, please explain

Rating scales

Rating scale questions, or ordinal questions, use a range of numbers to represent how a respondent gauges their response. Using a numerical system such as 1 being the lowest possible score and 10 being the highest (or some other predetermined context) lets respondents analyze their feelings. This also provides you with valuable quantitative (number-based) data.

Example: With 1 being not at all likely and 10 being extremely likely, how likely are you to buy this product again?

Likert scales

Likert scale questions provide respondents with a range of qualitative answers. They’re particularly useful in understanding the opinions or attitudes of people within the context of how much they agree or disagree with a particular statement on the survey.

Example: Our company offers many opportunities for career advancement.

Strongly agree

Agree

Neither agree nor disagree

Disagree

Strongly agree

Drop-down questions

Drop-down questions display a long list of possible answers in an easy-to-navigate drop-down scrollable list.

If you have a question with more options than could comfortably be viewed in multiple-choice format (for example, a list of countries), using a drop-down question can provide your answers more clearly. Drop-down questions are more difficult to respond to, so only use them when essential.

Example: Highest level of education completed:

Some high school

High school diploma or equivalent

Some college

Associate degree

Bachelors degree

Graduate degree

Doctorate

Open-ended questions

Stand-alone open-ended questions (not part of an "Other" option from a different type of question) stimulate the respondent to provide a genuine answer in their own words. Because there’s no fallback of a predetermined option, the respondent must generate their own response.

Although this information will not fit neatly into a quantitative coding system, the feedback you get will be valuable in truly understanding the thoughts of your respondents on your survey topic.

Example: What features of this service would you like to see improved?

Demographic questions

Including demographic questions in your survey allows you to understand your survey respondent's background, life situation, and income. This data can be useful when seeking patterns in your data or creating customer personas.

These demographic questions can cover information like age, marital status, race, education level, and occupation. It may reveal certain themes across your respondents' perspectives.

Example: Which category contains your household income last year?

$25,000 or less

$25,001–$40,000

$40,001–$75,000

$75,001–$150,000

$150,000 or more

Ranking questions

A ranking question lets the respondent put answer choices in order based on their personal preferences. These questions can feel labor intensive for the respondent, but they offer the researchers a glimpse into a comparison of various similar options.

Ranking questions require your respondent to be familiar with and have an opinion on each option. Use these questions only if you’re sure your options will be familiar to your target respondents—otherwise, your data may be skewed by random selection by the survey respondents. This problem can also occur when too many items are in the list.

Example: Rank the following items in order of importance to you. With 1 representing your highest priority and 4 representing your lowest priority, what do you consider most important in your morning routine?

( ) Eating breakfast

( ) Having coffee or tea

( ) Time for meditation or prayer

( ) Being on time for your scheduled activities

Image choice questions

An image choice question is a multiple-choice question where the answers are all images. Using an image choice question can give you valuable insights into what visuals appeal to your respondents and may be more engaging for respondents after a long series of text-based questions.

Example: Which of the following logos do you think best represents our brand?

Click map questions

Click map questions provide interesting insights into where respondents' eyes are drawn to in a certain image. These questions ask your respondent to click on whatever part of an image they want or find most appealing. These responses may have value in marketing or design.

Example: Which part of the following image do you find the most appealing?

File upload questions

File upload questions ask respondents to provide information through a file upload. These questions include requests for an ID, a resume, or a picture. This provides you with these responses in an easy-to-organize way, allowing you to download the files whenever you need them.

Example: Please upload a picture of the front of your state ID or driver’s license.

Slider questions

Similar to a rating scale question, a slider question asks respondents to provide a numerical answer based on their opinion on something. However, these questions provide a sliding scale the respondent can click on, which makes them feel more interactive and interesting to the respondent.

You get quantitative insights, and your respondents get a fun little break from repetitive question formats. Win, win!

Example: With 1 being Unlikely and 5 being Very Likely, use the sliding scale to select how likely you are to recommend our product to a friend.

Emoji or emoticon scale questions

Using emoji-like icons to have respondents give you feedback on their relationship to your brand or customer service is a great way to get rapid insight into their mood with very little effort on their part.

Example: How are you feeling about your investments with our bank today?

☹️😐🙂😃

The ideal survey length

If a survey is too short, you may not get enough data to draw conclusions about your respondents' overall feelings concerning your topic. However, if your survey is too long, you may notice a drop off in respondents after a certain number of questions and also miss out on data that you determined was important to gain.

You can avoid these traps by keeping your main goal clearly in mind and using close-ended questions for the bulk of your survey to make it easier on respondents.

The length of your survey can vary depending on the incentives you’ve offered for completion and the sense of loyalty your respondent feels toward your brand. A general guideline for a maximum response rate is to have customer surveys containing no more than ten close-ended questions. Adding more questions, especially open-ended questions, will result in a drop in the response rate.

Best practices for survey questions

When choosing your survey questions, keep in mind these best practices to get the most out of your survey:

Keep your goal clearly in mind, and ask questions that directly help you gain the information you need. Keep your survey as short as possible and focus on your main objective.

Use a mix of close-ended questions, with a few opportunities for open-ended answers towards the end of your survey. This will allow you to gain your most usable insights from the close-ended questions and your respondents' more complete thoughts after they’ve completed the bulk of the survey and are in a more focused frame of mind.

Include an incentive. Particularly if you expect your survey to run long, offering an extra incentive like a gift card or a sweepstakes entry might motivate more people to participate. Even if you don’t include an incentive, remind your respondents that the insights they share as part of your survey will help improve your product or service and therefore benefit them. It also helps to thank them for their time at the start and end of the survey.

Avoid questions that lead your respondents to a desired response, or isolate respondents that have had a negative experience with your topic. Keep your questions neutral and clear to gain the most valuable feedback.

Increase clarity in your questions by avoiding a double-barreled approach. Instead of asking for two pieces of information in one question, prioritize the main objective of your survey or break a double-barreled question into two separate questions. For example, instead of asking, "How would you rate the value and practicality of our product?", focus on one part of the question at a time.

Always proofread your survey questions for clarity. Take the time to check if a particular question would benefit from a sliding scale option or a drop-down list to make it easier for respondents to answer your questions.

Pre-test your survey on a variety of volunteers to see whether you’re gathering the data you need and whether the survey questions are being interpreted the way you intended. One way of doing this is to have a volunteer take the survey with you and “think out loud” as they work through it.

Final thoughts

This comprehensive list of survey question types is a great starting point in understanding which questions to include in your next survey.

Avoid overly complicated questions and a monotonous survey by mixing in different question types and answering formats. Using a variety of question methods will provide you with a mix of qualitative and quantitative information that will improve your marketing, product, company, and brand.

FAQs

What are the seven steps to conducting a survey?

Establish the purpose of your survey

Decide who will participate in your survey

Choose your survey template or style

Design your survey questions

Distribute your survey and collect the feedback

Code and review the survey responses

Notice patterns and draw conclusions from your survey data

Understanding the types of survey questions you can use will help you get the most out of your surveys. Depending on your specific needs established in 1) above, you may wish to use one or several of these question types.

What are the three types of survey research?

The three types of survey research are exploratory research, descriptive research, and casual research. While both descriptive and casual research focuses on gaining quantitative data that can be organized into themes, exploratory research looks at the ideas behind statistics.

Knowing what type of research you’re doing will affect what type of survey questions you focus on. In particular, exploratory research uses more open-ended questions.

What is the best survey question?

You’ll gain the most relevant and useful feedback by asking a variety of questions. If you want to ask one question that will quickly provide you with useful insights into how to improve your product or brand image, ask a question such as "What is your overall rating of this topic, and why?"

Should you be using a customer insights hub?

Do you want to discover previous survey findings faster?

Do you share your survey findings with others?

Do you analyze survey data?

Editor’s picks

Last updated: 28 June 2024

Last updated: 16 April 2023

Last updated: 20 March 2024

Last updated: 22 February 2024

Last updated: 13 January 2024

Last updated: 21 December 2023

Last updated: 13 January 2024

Last updated: 26 July 2023

Last updated: 14 February 2024

Last updated: 26 February 2025

Last updated: 18 December 2024

Last updated: 16 February 2025

Last updated: 30 January 2024

Latest articles

Last updated: 26 February 2025

Last updated: 16 February 2025

Last updated: 18 December 2024

Last updated: 28 June 2024

Last updated: 20 March 2024

Last updated: 22 February 2024

Last updated: 14 February 2024

Last updated: 30 January 2024

Last updated: 13 January 2024

Last updated: 13 January 2024

Last updated: 21 December 2023

Last updated: 26 July 2023

Last updated: 16 April 2023