Competitive intelligence 101: What it is & how to use it

Short on time? Get an AI generated summary of this article instead

How well do you understand your company’s competitors?

Regardless of the industry you’re targeting, high-performing brands always comprehensively understand the main players in the space. That includes their competitors, the needs and wants of their customers, and upcoming market trends.

The key to an excellent business is sustainable growth and expansion. If you’re looking for ways to build an empire, the answer lies in diligent competitive intelligence.

Competitive intelligence is crucial in creating impactful products that resonate with your audience. It’s the practice of collecting, interpreting, and using data about your customers, competitors, and target market.

Ongoing competitive intelligence research is one of the best ways to effectively establish your business as a leader in your industry. It’s ideal for fine-tuning your competitive advantage and better targeting your offerings to your chosen market.

If you’re looking for ways to improve your business, use this article as a guide to help you get a better understanding of competitive intelligence.

We’re getting into the different types of research, the best sources to explore for data, and a step-by-step guide to turning your research into actionable insights.

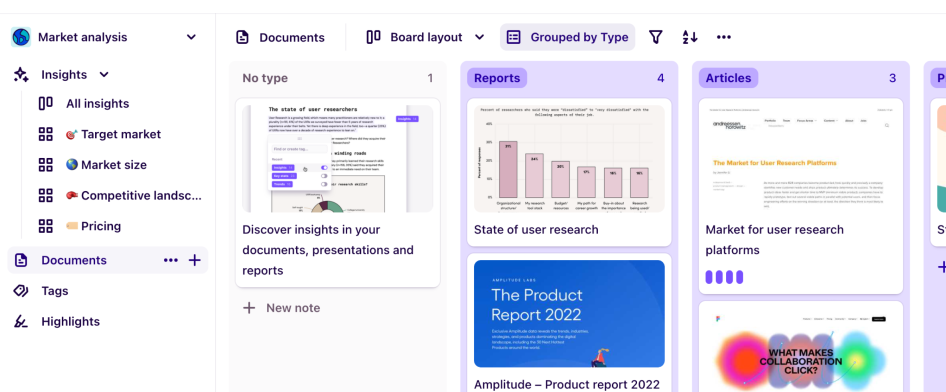

Market analysis template

Save time, highlight crucial insights, and drive strategic decision-making

Use template

What is competitive intelligence?

Competitive intelligence is where you ethically collect, analyze, and act upon data about your company’s competitors and customers. The goal is to create a more compelling competitive edge for your brand within your niche.

High-quality competitive intelligence research involves carefully listening and collecting information from published and unpublished sources. You’ll look at social media, customer testimonials, competitor marketing materials, and more.

The data you gather from these sources will teach you about your industry and audience, providing nuanced insights to improve all aspects of your business.

Regardless of your team's resources, you can get started on competitive intelligence quickly, with minimal overhead.

Companies of all sizes and niches can benefit from ongoing competitive intelligence practices. That’s especially true if you’re branching out into a new market or want to improve your current positioning against your competitors.

The data you collect during competitive intelligence is a powerful resource to better understand your category. You’ll uncover consumer needs and areas where your business can increase its market share.

The more nuanced and specific your competitor intelligence research, the more confident your team can be when deciding how to position your offerings within the market.

This approach will improve customer loyalty and satisfaction while clearly showcasing the benefits of your products or services over your competitors.

Types of competitive intelligence

Like anything else that involves collecting information about people or brands, your team must engage in ethical competitive intelligence practices. It’s the only way to avoid breaching professional or personal security boundaries.

Ethical competitive intelligence practices refer to data collection and analysis practices that are ethical and safe for your customers, competitors, and your team.

There are two primary categories within ethical competitive intelligence:

Tactical intelligence

Tactical competitive intelligence helps companies with short-term projects or problems by focusing on information that guides day-to-day operations.

This type of competitive intelligence will help your team gain insights into how to improve your positioning within the market. It’ll reveal ways to increase your revenue through short-term projects or positioning changes, helping you develop improved tactics to market your brand.

Strategic intelligence

Strategic competitive intelligence plays the long game, helping your brand collect important information and insights about the market landscape and ever-evolving consumer trends.

It includes practices like collecting historical data and analyzing customer behaviors.

This type of competitive intelligence will help your brand create a big-picture strategy for its future within your chosen niche.

Your team must understand they cannot cross clear ethical and security-based barriers during the process.

Whether they cross these lines accidentally or intentionally, your team is performing unethical competitive intelligence research. In some cases, this behavior can be illegal, resulting in significant punishments and reputational damage.

Examples of unethical competitive intelligence practices to avoid include:

Industrial espionage: Intentionally using illegal means to learn insider information to better position your brand within the market

Violating customer privacy protocols

How to conduct competitive intelligence research

Now your team is ready to start competitive intelligence research, follow this step-by-step guide:

Identify your competitors

First, your team needs to identify the companies you want to focus your research efforts on.

Choosing the proper brands to investigate is incredibly important to produce usable results. If you choose wrong, the results of your study will lack relevance.

Use a brainstorming meeting to share ideas and select competitors that offer similar products or services, even if they are significantly smaller or larger companies.

Here are some general guidelines to follow when choosing what to research:

Focus on two or three competitors in your industry to narrow your research scope

Avoid hyper-focusing on a single brand

Encourage your team to get curious about the unique selling points of your competitors

Pay attention to newly emerging brands in your industry

Begin collecting data

Once you’ve chosen the brands to target with your research, your team needs to start collecting data to identify trends and insights.

When collecting information, your team must find a way to cut through the clutter to gather relevant, reliable data. This exercise aims to find specific, usable data rather than simply collecting as much random information as possible.

The worst-case scenario for competitive intelligence is that your data is inaccurate or out-of-date. Bad data can lead to inaccurate business decisions and negatively impact your bottom line.

Poor decisions can also dent customer satisfaction, so take your time setting up your research system to target the info you want to collect.

Analyze for trends and insights

Once you have a data repository, your team can analyze trends to guide future decisions.

Using data insight software like Dovetail, your team can group raw data into trends that will provide compelling insights into your niche and industry.

Depending on the type of data you’ve collected, examples of trends to explore include:

The average price of a particular product across your industry

Peak months of customer activity

Competitors’ marketing messaging

Common customer pain points in your target market

Make impactful changes to your business practices

Once you have insights into your target market, you can reap the rewards of your hard work.

You can start implementing changes to your business structure and offerings based on your well-earned insights.

These changes might be small, like adjusting your marketing message, or significant, like pushing a new feature update. Either way, they should positively impact your brand if you’ve done your research correctly.

As your competitive intelligence research continues, you will gain more nuanced and detailed insights to adjust and adapt your business’s position within the market.

There’s no shortage of ways that competitive intelligence insights can improve and change your business. It’s capable of impacting everything within your business, from pricing and UI design options to internal structures and key stakeholder messaging.

Track your results

Finally, once you implement changes powered by competitive intelligence insights, track your progress and results to understand their impact.

Whenever you change your business, tracking the outcomes compared to your baseline is essential to see if the change has had the desired positive impact.

Not all changes will be the right fit, so regular assessments are the best way to catch potential issues before they become baked into your company’s day-to-day operations.

After implementing any business change, here are a few things we recommend measuring to ensure the best possible results:

Company key performance indicators (KPIs)

Competitor pricing and offerings

Changes in market trends or demands

Customer spending patterns and behaviors

There’s no perfect way to run your business, so find ways to enjoy the process of studying, analyzing, and adjusting to boost your chances of long-term success.

The best sources for collecting competitive intelligence

Now, your team is ready to explore the benefits of competitive intelligence for your brand. There are so many places you can start.

Here are a few sources that can help you begin your competitor intelligence journey:

Website analysis

Competitor websites are brimming with information about product features, pricing, blog topics, and marketing messaging.

Industry-specific publications

Industry magazines highlight upcoming launches and leaders in the space, making them a great source of information about future trends.

SEO tools

Search engine optimization tools offer a wealth of data about trending keywords. These are searched by your target audience and targeted by your competitors.

Customer reviews

Google and online reviews provide helpful insights into customer experience and satisfaction levels throughout the industry. This can illuminate pain points for your brand to focus on.

Social media

Apps like Facebook, Instagram, X (formerly Twitter), and TikTok are abundant resources of customer opinions, desires, and trends for your team.

Improve your competitor intelligence with Dovetail

Competitive intelligence is essential for any brand looking to flourish in their chosen industry—have you tried it yet?

As your team explores ways to integrate competitive intelligence practices into your process, using the right data analysis tools is crucial to reduce headaches and get the best results.

Streamline your competitive intelligence practices with Dovetail, your all-in-one tool for insights and analysis.

Built to help you make products and services your audience will love, Dovetail takes the hassle out of competitive intelligence data analysis by quickly identifying trends and insights.

Storing your research in one convenient location means your team can quickly and easily navigate through years of historical data. Get ready to explore themes, trends, and behaviors that will hugely impact how you approach your future projects and launches.

Should you be using a customer insights hub?

Do you want to discover previous research faster?

Do you share your research findings with others?

Do you analyze research data?

Editor’s picks

Last updated: 3 April 2024

Last updated: 17 October 2024

Last updated: 13 May 2024

Last updated: 13 May 2024

Last updated: 16 February 2025

Last updated: 10 January 2025

Last updated: 13 May 2024

Last updated: 3 April 2024

Last updated: 13 May 2024

Last updated: 3 April 2024

Last updated: 3 April 2024

Last updated: 3 April 2024

Last updated: 14 November 2024

Last updated: 2 October 2024

Last updated: 12 September 2024

Last updated: 23 July 2024

Last updated: 22 February 2024

Last updated: 13 May 2024

Latest articles

Last updated: 16 February 2025

Last updated: 10 January 2025

Last updated: 14 November 2024

Last updated: 17 October 2024

Last updated: 2 October 2024

Last updated: 12 September 2024

Last updated: 23 July 2024

Last updated: 13 May 2024

Last updated: 13 May 2024

Last updated: 13 May 2024

Last updated: 13 May 2024

Last updated: 13 May 2024

Last updated: 3 April 2024

Last updated: 3 April 2024

Last updated: 3 April 2024

Last updated: 3 April 2024

Last updated: 3 April 2024

Last updated: 22 February 2024