Conducting an effective competitor audit

Last updated

3 April 2024

Reviewed by

To build a successful business, you’ll want to know who your competitors are and how you can stand out. One way to approach this is to undertake competitive research or perform a competitor audit.

Competitive research is where you analyze your competitor’s strengths, weaknesses, and strategies. Analyzing the businesses you're up against lets you see where you can direct attention and sales away from them and toward your business.

You'll be looking at what they are doing right or wrong and how you can improve their offering to entice customers to your business. Let’s learn more about competitor audits.

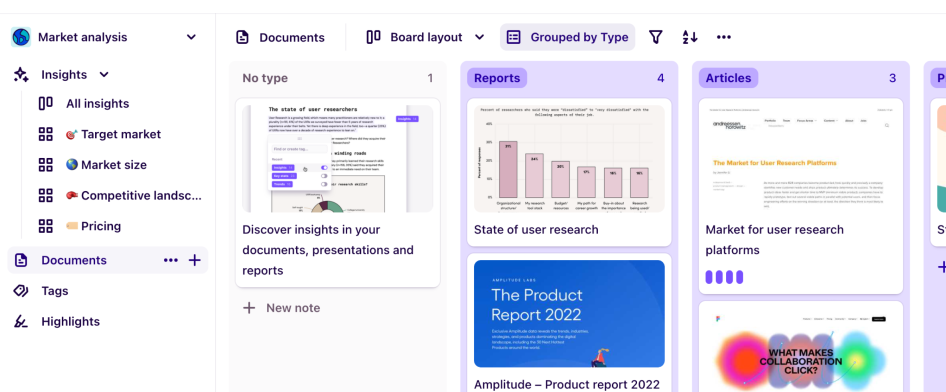

Market analysis template

Save time, highlight crucial insights, and drive strategic decision-making

Use template

Why perform a competitive audit?

A competitor audit or analysis is ideal for changing a product or finding ways to set your business apart, grow sales, and remain viable.

Competitive audits give you insight into what other businesses in your line are doing and help you analyze your business and its place in that market.

At a glance, you can see your strengths and weakness and your competition’s. It also highlights opportunities and threats, allowing you to prepare for change.

How to conduct an in-depth competitive audit

To conduct an in-depth competitor audit, follow these five steps in order. It’s also essential to take a thorough approach: The data quality, quantity, and detail will give you more insight to benefit your company.

These steps are:

Define the purpose

Determining what you want to achieve sets the project's scope, removing the chance of scope creep and working outside your intended purpose.

You will need goals of what you want to gather, such as identifying user loyalty or discovering the pros and cons of a service or product.

It’s also critical to be objective when comparing your business with your competitors. Bias can get in the way of valuable data. Being over-positive with your product and not acknowledging the value a competitor brings can invalidate your project’s time and effort.

Choose direct and indirect competitors

When you make a list of your competitors to research and analyze, you need direct and indirect competition.

Direct competitors offer the same value to potential customers as you do. If you operate a vintage jewelry store, so does your direct competitor.

Indirect competitors offer a similar proposition to different customers or have an extra product to offer the same customers. An indirect competitor may run a vintage clothing store and offer vintage jewelry.

It’s best to pick 2–3 direct and 1–2 indirect competitors for your audit.

Find competitors

When choosing your competition, look at surveys or market research interviews. Respondents may bring up relevant services or products they use that you don’t offer.

They can also come from related keywords or show as a "sponsored ad" when you Google your service or product.

Create a matrix

Once you get the list of direct and indirect competitors to analyze, create a matrix. You can use a simple spreadsheet to hold the data.

Some of the tabs can include:

The company name

Target audience or customer (demographics)

SWOT (strengths, weaknesses, opportunities, and threats)

Key differences (what they do better or worse than you)

Their reviews

Any unique features they have

Put all the data in the matrix and see how they stack up against each other.

Write a summary and action points to share

When you complete your matrix, summarize everything you found. You want the summary to directly reflect the goals you set in the beginning.

Now you can use the information to move forward with new opportunities and decisions on marketing, communication, sales, and branding. Remember to share these action points with the management team to see if they can spot any gaps or insight you missed.

Why competitive audits are key to strategy

Competitive audits are vital to understanding your competition, where you fit in the market, and how to use your competitive elements to your advantage. It’s a foundational tactic that offers insight and helps your brand.

As trends and markets evolve, staying on top of developments in your community and further afield helps you focus on your company's approach.

When is the best time to do a competitive audit?

Timing depends on your business strategy, but you can do monthly, quarterly, or annual audits.

An annual audit lets you see broad trends and gives you a large window of information.

Monthly or quarterly audits are better for businesses that undergo a lot of change and need up-to-date information on how those changes affect business.

If your business relies on riding short-lived trends, you should conduct a competitor audit more often than those in a more stable industry.

What mistakes do most companies make when conducting a competitive audit?

Companies can make a few mistakes when conducting a competitive audit analysis:

Not knowing their competitors

Not choosing enough competitors to get a thorough overview of the market

Not doing enough research to stay up on industry trends

Failing to monitor the internet for competitor moves

Stopping after one competitor audit and failing to update or spot-check data

Only sharing with a few people, diluting the value of the research.

Avoiding these practices will give you the full benefit of competitor audits.

What actionable steps can you take from the analysis?

Actionable steps in a competitor audit include:

Identifying your competition and your market

Analyzing the strengths and weaknesses of their business

Determining your competitive advantage

All of these steps ensure that you gain benefits from the analysis.

After analysis, actionable steps may include:

Rebranding a business

Brainstorming different products to stand out from the crowd

Creating new areas that would push your business forward, such as ebooks or webinars

Taking the data and putting it in perspective allows you to see where you are lagging or thriving.

Competitor analysis templates

FAQs

How do you compare two competitors?

You can compare and contrast two competitors’ strengths and weaknesses By doing an in-depth competitor audit. This shows you where the gaps are in the market and where your business’s product or service fails or rises to the top.

How do you classify competitors?

\You can classify competitors in one of three ways: Direct competitors, indirect competitors, or replacement competitors.

Direct competitors provide the same or similar service to yours and market to your customer base.

Indirect competitors provide the same or similar service to yours, but it’s not their primary focus or revenue source.

Replacement competition or disruptives have different products and services but can "replace" your service.

What are the contents of competitor audits?

An in-depth competitor audit should look at your competition’s:

Market share

Marketing

Pricing

Strengths and weaknesses

Differentiators

Features of your competition’s products and services

Management and employee expertise

Geography

Distribution channels

Culture

Reviews

What is a customer segmentation analysis?

Customer segmentation analysis is where you look at specific customer segments to gain insights. This research identifies ideal marketing campaigns and products for a particular demographic. It can also help you see the value of specific segments' purchasing habits by their average order, buying frequency, and loyalty.

What can you use the competitor audit data for?

You can use the data from the analysis to rebrand your business, expand, and tweak your product and service offerings to build a closer relationship with your customers.

You can also design more effective, unique promotions exclusive to your business. While these data analyses may take a while, the benefits you can gain are worth it.

Should you be using a customer insights hub?

Do you want to discover previous research faster?

Do you share your research findings with others?

Do you analyze research data?

Editor’s picks

Last updated: 3 April 2024

Last updated: 17 October 2024

Last updated: 13 May 2024

Last updated: 13 May 2024

Last updated: 16 February 2025

Last updated: 10 January 2025

Last updated: 13 May 2024

Last updated: 3 April 2024

Last updated: 13 May 2024

Last updated: 3 April 2024

Last updated: 3 April 2024

Last updated: 3 April 2024

Last updated: 14 November 2024

Last updated: 2 October 2024

Last updated: 12 September 2024

Last updated: 23 July 2024

Last updated: 22 February 2024

Last updated: 13 May 2024

Latest articles

Last updated: 16 February 2025

Last updated: 10 January 2025

Last updated: 14 November 2024

Last updated: 17 October 2024

Last updated: 2 October 2024

Last updated: 12 September 2024

Last updated: 23 July 2024

Last updated: 13 May 2024

Last updated: 13 May 2024

Last updated: 13 May 2024

Last updated: 13 May 2024

Last updated: 13 May 2024

Last updated: 3 April 2024

Last updated: 3 April 2024

Last updated: 3 April 2024

Last updated: 3 April 2024

Last updated: 3 April 2024

Last updated: 22 February 2024